DUT Credit Ltd is an innovative finance institution. The DUT Credit system is today guiding Diaspora remittances toward investments into Diaspora University Town (DUT).

DUT is a project by the Diaspora Kenyans, Ndara B Community and Partners that is progressing to create 20,000 jobs and produce a town with 30,000 residents, 7,000 properties, a university, a hospital, medicine vaccine plant and diverse Small Medium Enterprises (SMEs.)

The DUT Credit Ltd. team is at the last stages of fine tuning the system that today enables persons in the Diaspora remit their cash and investment toward jobs creation, houses development and creation of new wealth. The new wealth created through property development and establishment of SMEs at DUT.

Diaspora Kenyans with intellectual property in the form of technologies are today working closely with DUT Credit Ltd to achieve the set up of Companies in Kenya.

Daktari Biotechnology Ltd that is founded by Diaspora Scientists with technologies for medicines and vaccines production are today working with DUT Credit Ltd. to achieve the Capital for building and equipping the plant from the Diaspora remittances.

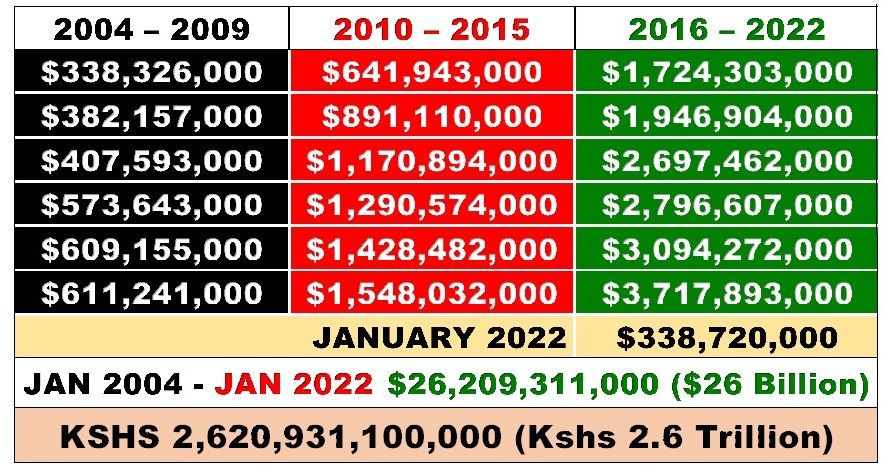

Diaspora remittances have grown over the years. The recording by Central Bank of Kenya (CBK) started in 2004 shows the Diaspora remittances from January 2004 to January 2022 totaling at $26 billion (about Kshs 2.6 trillion)

In the next 5 years Diaspora Kenyans are on track to remit $20 billion dollars (about Kshs 2.2 trillion). DUT Credit Ltd will benefit Diaspora Kenyans through offering them an opportunity to invest in jobs creation and in doing so create new wealth.

DUT Credit Ltd system is part of the DUT integrated and sustainable systems of jobs creation and housing development. The systems are for advancing the rights of a clean environment, healthcare, housing, clean water, education, children and other rights.

Those who become part of DUT will be able to remit their money to create jobs and develop houses. Every person in the Diaspora was able to settle in the country, city and town they live in because of the jobs created. Over the years and through a property mortgage, many in the Diaspora have their wealth in the property they live in and are owning through the mortgage finance.

DUT Credit Ltd. will record the movement of money from Diaspora to DUT development. The financial institution has also set up a capital management system that will progressively give reports of how the capital investment is growing.

DUT Credit Ltd is today enabling Diaspora Kenyans, their friends and Kenyans in Kenya to invest in companies that will shape the growth of Kenya in the next decade.

(Dan Kamau, formerly of Worcester, MA, is the Diaspora University Trust – Executive Trustee www.dut.or.ke and a Director in DUT Credit Ltd www.dutcredit.co.ke. Dan can be reached via Email [email protected])