Diaspora Kenyans have desired to have a Diaspora Bank in Kenya where they are shareholders. The idea was started based on Diaspora remittances and the view of how Diaspora can grow Kenya. The Central Bank of Kenya (CBK) records show Diaspora remittances total from 2004 to 2023 as $34 billion dollars (about Ksh 4 trillion.) Diaspora Kenyans have invested in different plans as shareholders. One plan is the DUT Credit Ltd plan being progressed by Diaspora University Town (DUT) plan to become a bank.

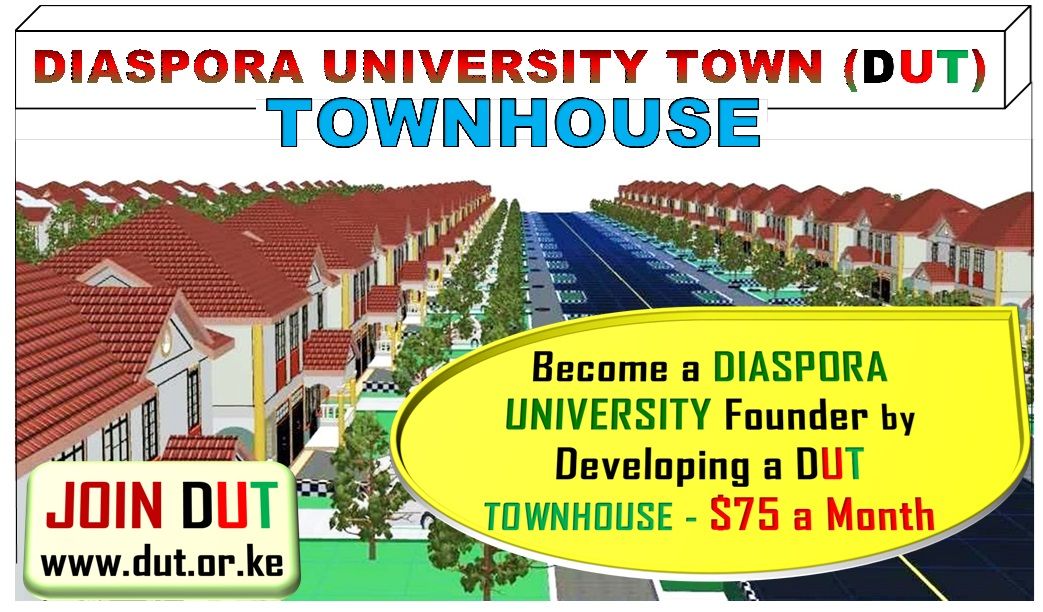

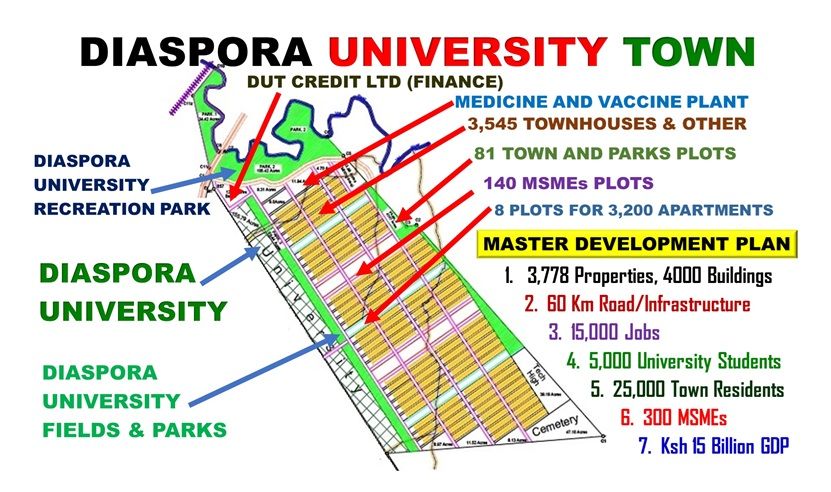

The Diaspora University Town (DUT) plan for developing a university, a hospital, a town and diverse MSMEs through a Master Development Plan (MDP) of jobs creation, housing development and Gross Domestic Product (GDP) growth. The DUT-MDP is for 20,000 jobs creation, 7,000 properties development and 300 MSMEs establishment. One of the MSMEs is DUT Credit Ltd.

To progress DUT Credit Ltd to become a Bank, the DUT-MDP will progress deposits and loan advances. The Diaspora Kenyans, as investors, will also meet the cash input requirement to get a CBK license. During the period of 2004 to 2022 as Diaspora remitted $29 billion the total bank’s deposits grew from Ksh 378 billion to Ksh 4.7 trillion. Loan advances grew from Ksh 250 billion in 2004 to Ksh 3.34 trillion in 2022. Diaspora remittances contributed to deposits and loan advances growth.

The DUT-MDP will achieve deposits of about Kshs 100 billion new bank deposits through: Diaspora Kenyans money remitted toward investments in DUT; Diaspora University endowment converted to students finance; natural resources from Ndara B Community that are applied in the construction of buildings and roads at DUT; savings as 20,000 people work at DUT and Ndara B; and, through profits made by the 500 MSMEs as they produce goods and services. DUT Credit Ltd can take up this deposits if Diaspora Kenyans input the capital needed for the license.

The DUT MDP creates an opportunity for loan advances of about Kshs 70 billion. The opportunity includes: personal loans given to individuals getting the 20,000 jobs, mortgage loans given to the 7,000 properties; and, business loans to the 300 MSMEs.

DUT Credit Ltd was founded by Diaspora University Trust, Diaspora Kenyans and Ndara B Community members to implement the DUT MDP finance plan. The share capital plan is for 2 million shares. Currently, DUT Credit Ltd share capital is at 1.3 million of 2 million shares allocated. To make this a Bank, the Diaspora Kenyans are organizing on how to take up the remaining 700,000 based on the plan of $10 a share and input of $7 million.

The DUT – MDP and DUT Credit Ltd, after the $7 million input, would in about 5 years reach the Ksh 10 billion revenue mark from the Ksh 100 billion deposits and Ksh 70 billion loan advances from DUT plan. 20% of the revenue, Ksh 2 billion, would be the net profit or the returns of the 2 million shares. Each of the 2 million shares would be getting a return of Ksh 1,000 (about $7 a year).

The deposits, loan advances, revenue and net profit would value DUT Credit Ltd at Ksh 20 billion. Each of the 2 million shares, valued at Ksh 10,000 (about $70). This means the $7 million Diaspora Kenyans input would grow in value to about $49 million. The $10 put in would make $7 annual return/dividend and have a valuation of $70.

Dan Kamau, is a former Diaspora of Worcester, MA. He is DUT Project Director and DUT Credit Ltd founding director. Email [email protected]