A mortgage is a loan that is advanced to a borrower to purchase a property. The property serves as collateral of the loan. The primary financiers of mortgages are the banks and financial institutions in a town or city. The secondary financiers are mortgage refinance companies that the primary financiers get the finance to finance the mortgages.

The two largest secondary financiers in the U.S, Fannie Mae and Freddie Mac, hold mortgage assets of about $3.5 trillion and $2 trillion respectfully. This is a total of $5.5 trillion in property assets. At an average of $150,000 a house; the two secondary financiers can be said to have facilitated the funding of about 36 million units of housing.

Kenya Mortgage Refinance Company (KMRC), started in 2018, has opened the Kenya secondary mortgage finance system. Just like the U.S companies, KMRC mortgage assets are expected to gradually grow as they finance completed housing units.

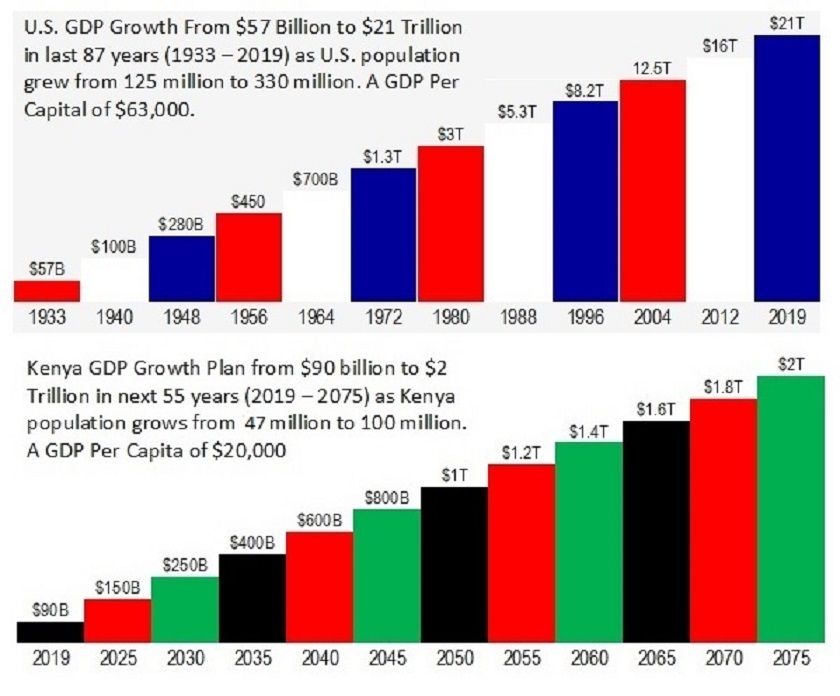

For a mortgage to work, the economic systems in the country producing the property to be financed have a positive impact on GDP growth.

Following the mortgage introduction in the U.S in 1938 through Fannie Mae, the U.S recorded a GDP growth, in 5 years, from $87 billion to $203 billion.

Similarly, when Freddie Mac was started in 1968 the impact on GDP in the next 10 years saw the U.S GDP grow from $941 billion in 1968 to $2.35 billion in 1978.

Kenya GDP is at $110 billion. Jobs creation and housing development funded through mortgages can grow Kenya GDP to even surpass the $500 billion mark in 10 years.

Diaspora University Town system is set up to grow GDP through making the human resource and land resources productive. Through the GDP growth, the DUT system will produce houses that those who produce are able to consume the houses.

The 30-year mortgage has become the best mortgage to support house production and home ownership. When the mortgage and jobs created are set the right way, the income derived from the job is able to pay the mortgage. The payer of the mortgage thus becomes the job created and the job income.

Jobs creation and housing development through sustainable systems will be able to meet the envisioned Kenya constitution rights, “Every person has the right to accessible and adequate housing, and to reasonable standards of sanitation; to clean and safe water in adequate quantities. Every person has the right to a clean and healthy environment.”

(Dan Kamau, formerly of Worcester, MA, is the Diaspora University Trust – Executive Trustee www.dut.or.ke and a Director in DUT Credit Ltd www.dutcredit.co.ke Dan can be reached via Email [email protected] )